Information

- Pays

- Vietnam

- Bureau régional de LuxDev

- Bureau Asie

- Secteur

- Finance inclusive et innovante

- Agence d'exécution partenaire

- Ministry of Finance

- PIC 3

- 2011 - 2015

- Période d'exécution

- 4 Janvier 2016 - 30 Juin 2022

- Durée totale

- 78 mois

- Budget total

- 4 160 000 EUR

- Répartition des contributions

-

- Gouvernement luxembourgeois

3 860 000 EUR - State Security Commission of Vietnam

300 000 EUR

Videos

Luxembourg supports early warnings system for Vietnamese Financial Market

From 8 – 12 April 2019, Project VIE/032 and Vietnam’s National Supervision Commission (NFSC) jointly organised a training workshop on an Early Warnings System for the financial market in Vietnam.

The five-day workshop, led by Banque Centrale de Luxembourg’s Senior Economics Consultant, provided concepts and a range of risk management tools to NFSC key officials. The workshop aimed to improve forecasting capability as well as analyse and assess risks to build an effective early warning system.

VIETNAM - Support Vietnam’s Securities Market Consolidation and Improve Training Capacities (VIE032 programme at a glance)

VIETNAM - Support Vietnam’s Securities Market Consolidation and Improve Training Capacities (VIE032 programme at a glance)

Évaluation intermédiaire

Évaluation finale

Renforcer le développement d’une économie dynamique dotée d’un secteur financier sain est l’objectif global du projet VIE/032.

Son objectif spécifique est de consolider le marché des valeurs mobilières du Vietnam conformément à la stratégie du gouvernement portant sur la période 2011-2020. Le cadre législatif devra dès lors être actualisé afin d’améliorer la restructuration du marché des valeurs mobilières, le processus de consolidation et la gouvernance.

Ce projet a obtenu trois résultats :

- le cadre législatif et institutionnel du marché des valeurs mobilières est actualisé ;

- les initiatives en termes de formation et d’éducation visent à améliorer la compréhension du marché des valeurs mobilières ; et

- la qualité des opérations et des transactions sur le marché des valeurs mobilières est améliorée.

Dernières nouvelles

VIETNAM - Online training benefits during the Coronavirus pandemic

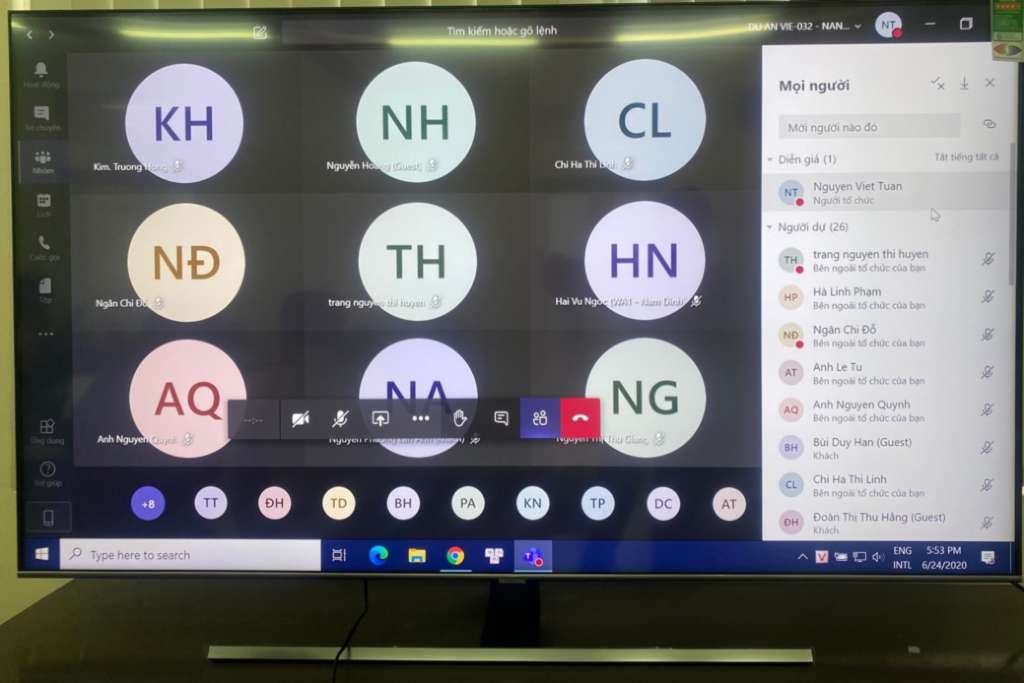

Even though most of social and commercial activities in Vietnam are frozen during continuous lockdowns lasted by the turbulence of COVID-19’s Delta variant since late July this year, the Capacity Building in the Financial Sector – VIE/032 project managed to keep its activities go on with regular catching-ups with its counterparts and stakeholders.

Members of Group 1. The class was divided into 4 groups

The last days of August, 2021 were marked by the first ever “Online Training-of-the-Trainers” course which aimed to consolidating online teaching skills for trainers of Securities Research and Training Center (SRTC) being under the management of the State Securities Commission (SSC) and having responsibilities to organize and implement researches, training and incentive training about securities, securities market, capital market, providing training services for organizations and individuals in securities fields.

Participants work on slido.com as an example for virtual training practice

This specific course came into reality despite face-to-face classes were impossible during the last few months whilst real need on online securities-relevant subjects from market learners soars (when people stay at home, more money is invested in stocks!), hence the needs for improving skills for trainers who deliver virtual courses fortifies. Not only SRTC trainers attended in the event, the target participants were extended also to visiting trainers from other market institutions such as Vietnam Securities Depository, Hanoi Stock Exchange, SSC, Securities Magazine and securities firm. This actually goes in line with the project document and plans of reaching out to wider groups of trainers in the entire capital market, who would be spreading their knowledge to employees within their organisations and other market players.

Ice Breaking

Sitting at their home offices across the currently quiet city of Hanoi, the trainees were introduced to and guided through various functions of the MS Teams itself and other training supporting platforms like Kahoot, Slido, Quizzi, Mentimeter and particularly MS Whiteboard for finance and securities contents. While some at the beginning showed their lack of confidence working with new software and sites, the training was confirmed informative and helpful with lot of interaction and practice. “Very interesting! We now know quite a bit of tips and I am happy there are still lots to be explored and applied. The trainer has been super supportive”, Mr. Minh Vu from Vietnam Securities Depository expressed. He was not the only one who appreciated such a course as Ms. Huong Nguyen, SRTC’s Deputy General Director and also a participant said when closing the course: “It is absolutely on-time for us and I could see clearly how it would help us: saving time and costs, reaching for more learners, making screen-to-screen classes much more lively.” “We have received remarkable funding from Luxembourg for many of our activities during the last two years and been so thankful for LuxDev and VIE/032’s meaningful supports”, she said her center would be more efficient and more market oriented in the coming time with “SRTC fully operational with digitalized resources and systems thanks to those great supports”.

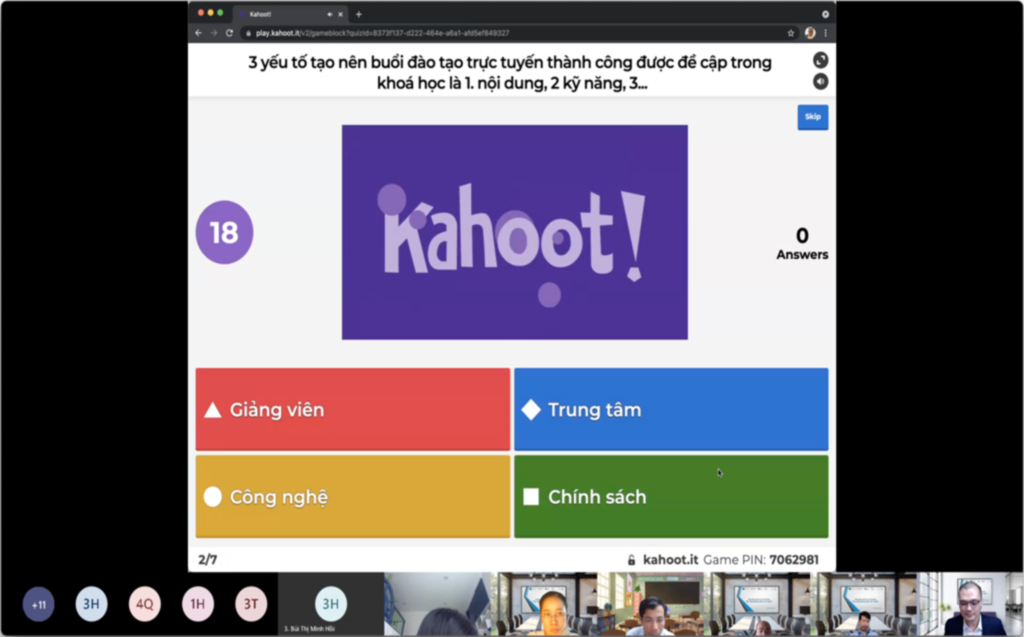

Participants attending Online Training-of-the-Trainers course, 25-26 August 2021

Final evaluation of the course received very positive feedbacks and the demand for an advanced follow-up course was raised. Financial market has never been an easy playfield, even for those who are behind the podiums or with the whiteboards delivering lessons.

The Capacity Building in the Financial Sector – VIE/032 project is co-financed by the Government of Vietnam and the Grand-Duchy of Luxembourg and is implemented by the Vietnamese State Securities Commission and LuxDev, the Luxembourg Development Cooperation Agency.

VIETNAM - The project VIE/032 continues supporting to Vietnam’s development of Financial Market Development Strategic Plan 2021-2025

A virtual roundtable on “Vietnam Financial Market Development Strategic Plan 2021-2025, Vision to 2030" drawed attention of almost 50 speakers and advisors, including officials and technical experts representing such strategic economic and financial organisations of Vietnam as Central Institute for Economic Management or Department of Finance and Monetary from Ministry of Planning and Investment, National Institute for Finance and Department of the Insurance Supervisory Authority of Ministry of Finance, State Bank of Vietnam, State Securities Commission, Securities Companies, Insurance Companies, Commercial Banks.

The event took place on 15 June 2021 and jointly organised by the National Financial Supervisory Commission (NFSC) and Project VIE/032 – Capacity Building on Finance Sector on both online and offline platforms. This was to ensure Vietnam government’s required distancing during the heat of Hanoi’s summer and fourth wave of COVID-19.

Mr Hung Xuan PHAM opens the virtural roundtableThe roundtable focused on:

- development model of financial markets in the coming time: bank-based or market-based (focusing on strong capital market development);

- establishment of a Regional Financial Centre in Vietnam;

- orientation and solutions to develop digital economy and digital banking (fintech);

- promotion of fair competition and transparent information on financial market and protection of financial consumers;

- supervision and ensuring of safety and soundness of the financial system.

Mr Kien LE from State Bank of Vietnam on his presentation on national finanancial market supervision standardsBased on opinions, advices and policy recommendations at the roundtable, NFSC would complement and finalise their Report on Strategy and Orientation for Vietnam Financial Market Development that would be submitted to the Prime Minister.

Financial and economic experts discussing protection of financial consumers in VietnamBeing one of the project’s active stakeholders, in late 2019, NFSC received supports from the project for organising its annual National Financial Report Launching Workshop that was warmly welcomed by national and international financial and economic institutions, donors and press media. Since the 2020 event could not happen due to the global pandemic, NFSC saved this roundtable opportunity to collect and advocate ideas with top technical experts and professionals. Mr Hung Xuan PHAM - General Director of Financial Supervisory Policy Coordination and Research Department of NFSC and his colleagues expressed great appreciation to Luxembourg and LuxDev’s meaningful cooperation and supports so far, not only in organisation of these critical high-expertise events but also in other training and capacity building activities to the NFSC.

Screen recorded 32 online participants attending the RoundtableThe Capacity Building in the Financial Sector – VIE/032 project is co-financed by the Government of Vietnam and the Grand-Duchy of Luxembourg and is implemented by the Vietnamese State Securities Commission and LuxDev, the Luxembourg Developmen Cooperation Agency.

VIETNAM - Luxembourg continues supporting Vietnam’s Securities Market Development Strategy for 2021-2030

With continual and fast growing stock market in Vietnam, Vietnamese securities regulators are paying their great attention to the next development of the Securities Market Development Strategy for 2021-2030 which is responsible by the State Securities Commission (SSC). The expected strategy heads to a more comprehensively structured, more open and integrated as well as more competitive plus resilient market.

Virtual forums are quite efficient in gathering comments and opinions from experts all over the world during COVID-19 times.

Virtual forums are quite efficient in gathering comments and opinions from experts all over the world during COVID-19 times.To this effort under the VIE/032 project scope, Luxembourg has played key role and so far only a mobiliser of technical assistance in supporting this action.

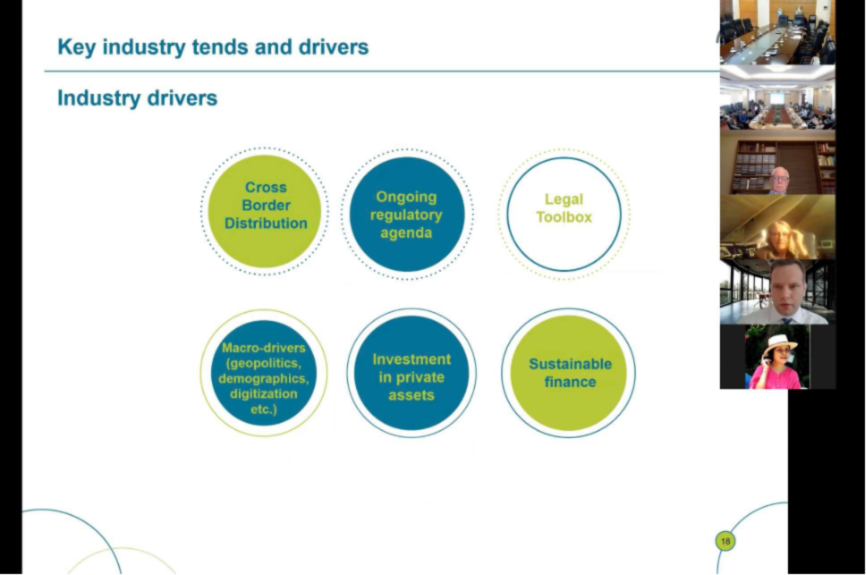

From 06 to 19 April 2021 the SSC in Hanoi organized 07 continuous virtual meetings focused on various key topics including

- securities trading markets and development of products;

- securities registration, depository, clearing and settlement;

- development of securities companies;

- fund industry;

- supervision, inspection and sanctions; and

- international integration.

The participants from Ho Chi Minh City Stock Exchange (HOSE), the Hanoi Stock Exchange (HNX) and the Securities Depository Centre (VSD), Securities Research and Training Center (SRTC) and technical departments of SSC attended the meetings.

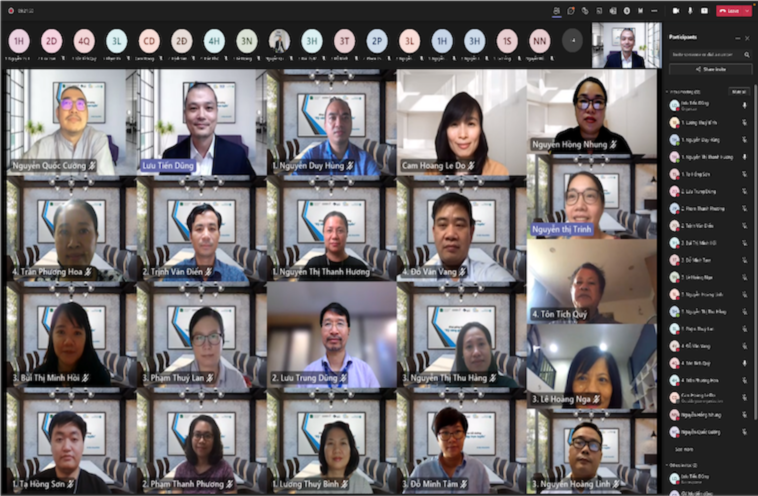

Sustainable and green finance attracted great attention from regulators and market stakeholders in Vietnam during elaboration process of Securities Development Strategy

The workshop was facilitated by international and regional advisors who are from the Association of the Luxembourg Fund Industry (ALFI), Luxembourg Institute of Directors, and Luxembourg Blockchain Association, the United States, and Thailand. The meetings provided the opportunities to the participants to exchange ideas, share best experiences and lessons learnt from world market as well as recommendations for the Vietnam’s market direction.

The workshops discussed sustainable finance opportunities for Vietnam, in line with Ministry of Finance’s direction. This is also an obvious advantage from Luxembourg as a hub of global financial market, where Vietnam could much benefit from exploring and learning from its broad experiences and advanced practices.

According to Pierre Oberlé, Senior Business Development Manager at ALFI: “sustainable finance will become the norm and investors will be keen to pay or to integrate the additional costs that this type of product has to deal with.”

Luxembourg Fund Industry practice

Luxembourg Fund Industry practiceOberlé also pointed out in one of the virtual discussions with SSC that when it comes to attract foreign investors into the sustainable market in Vietnam, the country would first need to access what type of assets its currently has, which meet the sustainable finance criteria and norms in different jurisdictions. Additionally, Vietnam ought to develop the expertise necessary for the sustainable financial market development, in terms of market capacity and human resource training.

As a number of complex issues were raised, discussed and cleared during these online forums thanks to the straightforward exchanges by the participants and the advisors, the SSC gladly welcomed all comments and recommendations contributed. Mr. Pham Hong Son, Vice Chairman of SSC who chaired the overview session expressed: “we highly appreciated the support from Luxembourg Government to the SSC of Vietnam, that has been well managed and implemented by LuxDev, particularly shown via these interactive and fruitful workshops. We have learnt a lot.”

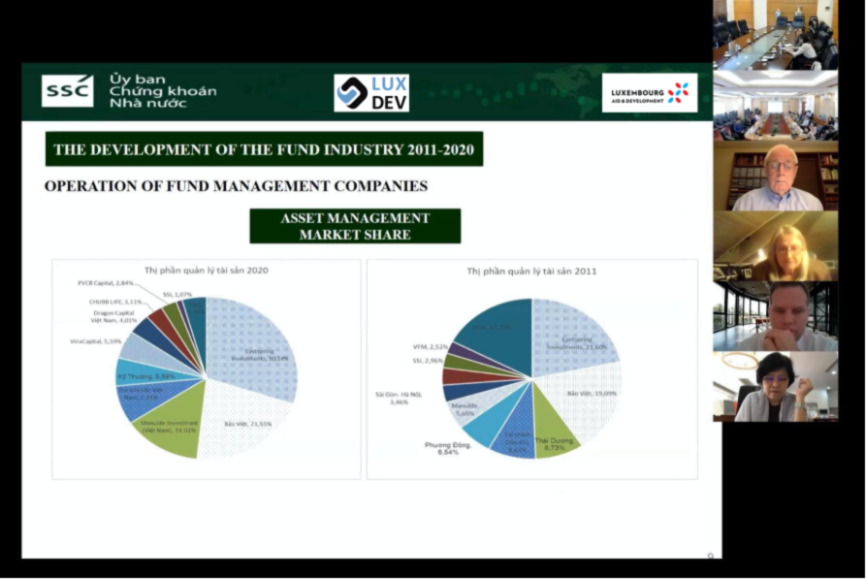

A brief overview of Vietnam Asset Management Market Share

A brief overview of Vietnam Asset Management Market ShareThe Strategy is now being consolidated as it is expected to receive comments from relevant market stakeholders in May and thereafter to be submitted for approval from Ministry of Finance on 2nd June 2021.

The Capacity Building in the Financial Sector – VIE/032 project is co-financed by the Government of Vietnam and the Grand-Duchy of Luxembourg and is implemented by the Vietnamese State Securities Commission and LuxDev, the Luxembourg Development Cooperation Agency.

VIETNAM - Improving securities knowledge through online training

As an immediate response to the COVID-19 pandemic, a first online course was organized by the Securities Research and Training Center (SRTC), under the State Securities Commission of Vietnam (SSC), with funding for training equipment and digitalised content provided by Project VIE/032 – Support Vietnam’s Securities Market Consolidation and Improve Training Capacities. The course on “Law on Securities and Stock Market” has been on the wish list of many market participants since the beginning of the year, when the virus outbreak started to prevent all gatherings.

Mrs. Ta Thanh Binh – First “online” trainer for the SRTC “Law on Securities and Stock market” course

Mrs. Ta Thanh Binh – First “online” trainer for the SRTC “Law on Securities and Stock market” courseThe training not only complied with the requirement of social distancing, but also serves as a milestone for the dissemination of securities knowledge for the SRTC’s first online dissemination activity regarding securities knowledge. Mrs. Ta Thanh Binh, Trainer and General Director of the Market Development Department of SSC, stated that “Investors or those who need a certificate to perform as market practitioners will have access to the required knowledge in the most convenient way, which is also more widely disseminated. Students are excited about the convenience and the time gained with this form of learning form, which is both trendy and necessary, especially for those who come from remote geographical areas”.

The digitalisation of the securities knowledge training programs actually has been a part of SRTC’s strategic plan for a while, but was not realised until VIE/032 stepped in to support the centre to keep up with a modern teaching & learning style and the high demand of learners. In the near future, more trainings will be conducted by using the technical infrastructure supported by the project with the aim of improving the quality and of diversifying the training products of SRTC, given that it is the only securities training institution for the time being. Practitioners and investors now have a better choice of courses with flexible timeframes and better fees.

On the opening day of the course – a milestone for SRTC - on behalf of a beneficiary, Mr. Hoang Manh Hung, Director, was happy to state that his centre “will apply information technology to deliver knowledge to the web system and provide software for students, and that the knowledge will be accessible for not only domestic investors but also international investors who consider investments in Vietnam.”

The training course titled “Law on Securities and Stock Market” takes place at 17:30 – 21:30 on Mondays, Wednesdays, and Fridays between 10 June and 10 July 2020.

VIETNAM - Regulators learn new derivatives techniques

Following the successful series of trainings on derivates for the members of the Vietnam Securities Business Association in 2019, the Capacity Building in the Financial Sector Project VIE/032 has started the year 2020 with another course on derivates for regulators from the State Securities Commission, Hanoi Stock Exchange and Vietnam Securities Depository, which took place between 24-27 February. The training was commended by the 50 participants who enhanced their knowledge on derivatives and the derivatives market. They notably appreciated the opportunity to gain broader knowledge and new practical techniques delivered by a recognized and experienced trainer, with the support from Luxembourg.

The training course, while covering types of contracts, systematic risk and portfolio management, introduced a number of real-life examples and exercises that taught trainees how to avoid common mistakes and pitfalls. While recapping parts of notions of derivatives and types of contracts, the success of this course stemmed from the fact that the trainer dug into core issues and focused on “critical things to remember”, making sure participants master a variety of aspects and handle derivatives without difficulties.

A survey carried out after the completion of the four-day training workshop showed that 82% of trainees found the practical lessons to be most interesting, while the usefulness of the course was rated highly by all.

It is absolutely what I expected to learn: Various sophisticated topics explained in an easy-to-understand language. I find it very useful for my work now and for the future.

Ms. Van Nguyen, Vietnam Securities Depository.

Meanwhile, from the perspective of a regulator from the SSC, Mr. Anh Nguyen stated that he was happy that he had the opportunity to put himself in the seat of a trader in an exercise, as it helped him to see things from a different point of view.

More than two years on since being established in Vietnam, derivatives and the derivatives market still remain a big challenge for stakeholders in such a newly developing market. In order to boost the market, it requires the active involvement and exchange between qualified professionals, from regulators acting as instructors and facilitators, to product developers at stock exchanges, bankers as brokers or traders or intermediaries, and investors. As elsewhere, authorities aim to operate the derivatives market as a channel for risk reduction and redistribution on the ground of underlying market and as a price stabilizer.

Further exchanges with participants reveal that they want to take further, more advanced courses on derivatives, in addition to other subjects such as risk management, bonds and bond products, fintech and corporate governance. “We are very grateful to have received technical support from Luxembourg in courses such as these, where many people are exposed to Luxembourg’s advanced knowhow on stocks” said Mr. Dzung Vu Chi, Director General of the SSC’s Department of International Cooperation.

VIETNAM - New Securities Law passed by the National Assembly, officially taking effect in 2021

On 26 November, the National Assembly officially gave the green light to the new Securities Law after it was voted by elected deputies. The amended Law on Securities will replace the previous version and take effect from the 1st January 2021. It consists of 10 chapters and 135 articles regulating securities and securities market activities, the rights and obligations of institutions and individuals operating in this field and the organization of the stock market

Delegates of the National Assembly vote on the amended Securities Law at the eighth session of the 14th National Assembly on 26 November 2019. © Finance Magazine of Vietnam

Delegates of the National Assembly vote on the amended Securities Law at the eighth session of the 14th National Assembly on 26 November 2019. © Finance Magazine of VietnamThe approval of the new law comes after years of hard work that the local authorities put into the revision of the old law, taking into account both the recommendations of both local and foreign experts and the lessons learnt from other international capital markets.

It is also important to acknowledge the contributions of international experts mobilized within the framework of the Support Vietnam’s Securities Market Consolidation and Improve Training Capacities Project, VIE/032, as well as the support received from financial institutions based in Luxembourg and other European countries.

Project VIE/032 in particular, has provided the State Securities Commission (SSC) with appropriate advice and recommendations on the new Securities Law including on key policy areas such as public offering and private placement, securities intermediaries, information disclosure, and corporate governance. This will ultimately help Vietnam to build financial sector capacity by upgrading the stock market’s legal and governance framework.

The National Assembly decided that there shall be only one stock exchange responsible for the administration and risk management of the stock market and the organization of securities transactions. However, as the restructuring and merging of the two exchanges will not happen immediately, the government will progressively redefine the functions and tasks of the Hanoi Stock Exchange (HNX) and the Ho Chi Minh City Stock Exchange (HSX). For now, both stock exchanges will be managed and operated separately in a bid to strengthen their operational efficiency prior to a future merger.

Accordingly, all bond and derivative securities transactions will now be conducted at HNX, while all stock transactions will be handled by HSX, which will subsequently help to establish a single index across the system.

VIETNAM - Derivatives training course lauded by market participants

From 4-6 September 2019, the project "Support Vietnam’s Securities Market Consolidation and Improve Training Capacities" (VIE/032), in collaboration with the Vietnam Association of Securities Business (VASB) and the State Securities Commission of Vietnam, organized a training seminar on derivatives. The three-day training course was well received by more than 70 attendants who come from securities companies and are also VASB’s members.

As an emerging financial market, Vietnam requires proper guidelines on various aspects of the capital and derivatives markets in a bid to attain sustainable stock market development. A steady foundation built on knowledge and expertise for market practitioners and members in this way can help the capital market gain great investor confidence and upsize market capitalisation.

“Vietnam’s derivatives market was set up only two years ago and a great effort has been made by the state securities commission in collaboration with leading securities firms in creating a set of regulations, procedures and an operation manual for the derivatives market,” said Vietnam Association of Securities Business’s Vice Chairwoman Hoang Hai Anh.

According to Hai Anh, while certain derivative products have already been launched onto the market, it is still very early days in the development of such a complex market. “For the sake of broader development, the market would definitely need a wider range of primary products, like index derivatives or government bond futures, that cater to the sophisticated needs of domestic and foreign investors.”

“This valuable training course on the derivatives markets, together with the sharing of experience by derivatives market practitioners, has indeed provided us with an improved theoretical and practical understanding of the subject,” said Nguyen Viet Quang, General Director of Yuanta Securities Vietnam Hanoi Branch.

Upon completion of the course, Mr. Marc de Bourcy, Deputy Head of Mission from the Embassy of the Grand Duchy of Luxembourg handed the Certificates to participants and mentioned that Luxembourg is keen to strengthen links with its pioneering capital market. “The financial linkages between the two countries are more than ever actively promoted through various activities in the framework of VIE/032”.

A similar workshop mobilized more than 60 participants from the same target groups in early October 2019 in Ho Chi Minh City. It’s expected that VASB members and securities practitioners nationwide will now be able to apply the skills developed within the framework of these workshops and contribute to the sustainable development of the stock market.

VIETNAM - Highlights of the Capacity Building in Finance Sector Project Third Steering Committee Meeting

On 8th May 2019 the Capacity Building in Finance Sector Project VIE/032 hosted its third Steering Committee (SC) meeting in Hanoi Vietnam. The meeting was chaired by the State Securities Commission (SSC) Chairman – Mr. Tran Van Dzung and co-chaired by Mr. Sam Schreiner – Chargé d’Affaires of the Embassy of Luxembourg in Vientiane. The meeting was attended by senior officials from the Ministry of Finance, Ministry of Planning and Investment, Luxembourg Embassy in Bangkok and the Luxembourg Development Agency, LuxDev.

Key project stakeholders gathered to discuss implementation progress, challenges and endorse the annual workplan and budget for 2019. The meeting also discussed strategic initiatives extending beyond the next year.

“2018 was seen as a successful year for the project with a number of activities having made remarkable progress, particularly the drafting of the revised Securities Law which will be submitted twice to the National Assembly for debates in 2019”, said Mr. Dzung, Chairman of SSC.

Both representatives from the Ministry of Finance and the Ministry of Planning and Investment in the meeting expressed their support to VIE/032 saying they would facilitate any administrative formalities for the formal approval of the project extension.

Mr. Marc de Bourcy – Deputy Head of Mission of the Luxembourg Embassy in Bangkok, Thailand - representatives from other national beneficiaries such as the National Financial Supervisory Commission (NFSC) and the Securities Research and Training Center also attended the meeting as observers.

While NFSC’s Ms. Duong Thu Phuong – Director of International Affairs Department - showed her strong appreciation for Luxembourg’s support in strengthening the capacity of NFSC’s key personnel and helping them to fulfil functions as assigned by the Prime Minister through various technical interventions; the meeting also spent time conferring on how to leverage Luxembourg expertise and support.

At the end of the meeting, participants were invited to watch a video clip “VIE/032 – 2018 At A Glance”.

To watch the video clip: please click here

VIETNAM - Luxembourg supports early warning system for Vietnamese Financial Market

From 8 – 12 April 2019, Project VIE/032 and Vietnam’s National Supervision Commission (NFSC) jointly organised a training workshop on an Early Warnings System for the financial market in Vietnam.

The five-day workshop, led by Banque Centrale de Luxembourg’s Senior Economics Consultant, provided concepts and a range of risk management tools to NFSC key officials. The workshop aimed to improve forecasting capability as well as analyse and assess risks to build an effective early warning system.

The trainees had opportunities to apply early warning system models and work on the pros and cons of each model in a policy assessment process.

A tool such as an early warning system is not only vital for maintaining the stability of Vietnam's financial market but also ensures that NFSC can fully play their rolein supervising and assessing risks for the entire financial sector: from banking, securities, insurance to a large number of financial corporations, as well as in building financial forecast models.

Based on their experience with this course, NFSC will consider developing an adaptive model that meets the needs of Vietnam’s financial market based on the skills and knowledge transferred through Luxembourg know how.

VIETNAM - Securities Law revision on the move

Between October and November 2018, the Vietnamese State Security Commission (SSC) with the support of VIE/032 project, organised three consecutive consultation workshops on the amended Securities Law in three regions (Danang, Hanoi and Ho Chi Minh city) of Vietnam. The workshops were designed to encourage dialogue and consensus building between relevant agencies, organisations and participants, discuss intellectual property rights and raise awareness of these issues within the framework of the securities market.

The first workshop collected feedback from representatives from the Government Office, National Assembly Economic Committee, Ministry of Justice, Ministry of Finance, Ministry of Security, Securities Business Association, Fund Management Club and securities firms.

The second and third workshops were broader events with mixed public (Economic Board of Consultants to the Prime Minister, Ministry of Finance, SSC and the Securities Law Editorial Board) and private (stock exchanges, fund management companies, auditing companies, banks (supervisory, custodian, settlement), reputable publicly listed companies) sector participants. These workshops were also publicised by the major news outlets in the northern and southern areas of the country.

The Securities Law constitutes the legal framework for the operation and development of securities and was introduced to the public in 2006 and revised in 2010 along with the bylaw documents. According to the Vice Minister of Finance, Huynh Quang Hai, who chaired the two workshops in Hanoi and Ho Chi Minh City, “the Law has contributed to boost the development of the securities market in Vietnam in view of it becoming the long-term capital mobilisation channel for the national economy.”

Figures show that the securities market in Vietnam has boomed over recent years with the number of listed companies having multiplied by 7 between 2016 and end 2017 to reach a current number of 1 537. Market capitalisation for these companies stands at VND 3.8 trillion (about 162M USD) equivalent to 77 percent of GDP, a 55 percent increase on 2016.

According to Mr Hai, “the stock market has efficiently supported an open, transparent capitalisation process for State-owned enterprises (SOEs) which has accelerated the restructuring of SOEs over the past 11 years. Despite the general development of the market, discrepancies and shortcomings of the Law have been exposed and noted. It is therefore now critical to have it updated and revised for an improved legal framework for the management of the stock market”, Mr. Hai insisted.

During the workshops, comments were collected from approximately 330 participants in total and are currently being worked on by SSC and converted into further revisions and updates. Discussions in these forums covered a wide range of issues relevant to the Securities Law although topics such as the organisation of the stock market, public offering, foreign investment attraction, information disclosure, stock business, regulations for securities company/securities investment fund/fund management companies drew the most attention. The revision is also considered to be well aligned with other Laws, mainly Enterprise Law, Investment Law as well as Credit Institutions Law.

The draft (amended) Securities Law, which is supposed to be submitted to the National Assembly in its 7th meeting session in May 2019 and considered for approval in the 8th session in October 2020, is expected to develop a stable, safe and sustainable legal stock market environment. Market supervision requirements, particularly in terms of protecting eligible rights and investor benefits, will ensure that the stock market contributes to mid and long-term capitalisation channels for the national economy,” shared Mr. Nguyen Quang Viet – General Director of Legal Department of SSC during the Ho Chi Minh City workshop.

Amendments to the Securities Law, understood as upgrading securities market legal and governance framework, is one of the three results of Project VIE/032. “The support from Luxembourg’s Government and the active role of Luxembourg Embassy and Lux-Development in this financial sector is highly appreciated,” expressed Mr. Tran Van Dzung, Chairman of SSC. “Many good lessons have been learnt from international experts sourced by Project VIE/032, that have helped us cut short unneccesary steps and head in the right direction of consolidating the amended Law”.

VIETNAM - Workshop on the Financial Conglomerates Supervision

Danang has recently witnessed the first training workshop on the Financial Conglomerates Supervision in Vietnam under the framework of Project VIE/032 – Capacity Building in Finance Sector. The intensive three-day training, from 27 to 29 August 2018, was jointly held by Project VIE/032 and Vietnam’s National Financial Supervisory Commission (NFSC).

Despite NFSC being the only institute assigned for Financial Conglomerates supervision in Vietnam by the Prime Minister’s decision since 2015, with a specialised Financial Conglomerate Department being responsible for 8 potential financial conglomerates (if so-called) (i.e. 7 bank-holding companies & 1 insurance corporation), the Vietnamese regulatory regime for a financial conglomerate is currently basically an institutional approach with separate requirements for banks, securities firms and insurance companies. Until a national supervisory framework or concrete guidelines for financial conglomerate supervision are available, a number of potential risks threaten the financial market in Vietnam. It has become an urgent need for NFSC to get updated with latest information and shared with knowledge and skills by one of the experienced conglomerate supervision example countries within the region. Experts from both public regulators and private sector on Conglomerates from South Korea (Korean Financial Supervisory Services, Shinhan Financial Group, and one of the top professors on risk contagion within Financial Conglomerates from Dongguk University in S. Korea) were therefore chosen as speakers and facilitators for the workshop.

The training workshop draw attention from various financial institutions and entities. In addition to majority of participants coming from NFSC, the rests were from Ministry of Finance, State Securities Commission, Insurance Supervision Authority, Central Economic Committee, Economic Committee of National Assembly, financial and economics academy/university/college, as well as from banking sectors (State Bank of Vietnam and other state-owned commercial banks).

Issues exchanged in the event have been of great interest for all participants, which covered from legal issues such as building up legal frameworks for conglomerates, conglomerates identification, international supervision and examination standards (criteria, information collection), reporting regulations and typical models to technical matters as risk contagion, information sharing and feasible problems/challenges to be resolved; study cases were also shared by the speakers.

NFSC’s Deputy Manager of Conglomerates Supervision Department, Mrs. Thi Minh Nguyet NGUYEN, shared her view that the three-day event has satisfactorily reached her expectations: “The training is quite useful with loads of information; the presentations and discussion focus right on the knowledge blanks I wanted to fill”.

Mr. Huy Tuan HA, Vice Chairman of the NFSC, expressed his appreciation of the training contents and highly valued the support from Luxembourg to this event, saying: “the support from Luxembourg’s government through the activities of Project VIE/032 is very much appreciated. With that, we could grasp a dear opportunity to have our staff’s knowledge widened and skills sharpened, which clearly helps improving the capacity of NFSC’s personnel on this absolutely important subject.”

After the training, the NFSC is expected to “step by step strengthen its conglomerate supervision activities by consolidating supervisory and examination criterion with more detailed and systematic guidelines in data collection and calculation, providing further trainings for Conglomerates Supervision Department’s staff, improving supervision data infrastructure, reinforcing information sharing mechanism amongst relevant departments, and continuing seeking for international technical assistance in development of supervision processes/criteria in line with both international practices and Vietnam’s circumstances”, said Mr. Tuan.

VIETNAM – Seminar on Securities Law Revision

Project VIE/032 and Vietnam's State Securities Commission (SSC) held a two-day internal seminar on 13 & 14 July to discuss amendments to Securities Law which was last revised in 2010 whilst the market's rapid growth has since required further updates to ensure effective operation.

The seminar was chaired by SSC Deputy Chairwoman Vu Thi Chan Phuong, who was joined by Vu Bang, SSC former chairman and now member of Board of Economic Consultants to the Prime Minister, together with Nguyen Trong Nghia, consultant of the finance ministry and who used to head the ministry's legal department. SSC Chairman Tran Van Dzung also made a brief attendance on the final day.

Discussions on the law's amendments were shared among SSC inspectors and officials from its seven departments, namely legal, IPO management, public company monitoring, market development, trading management, fund management and market monitoring departments.

Following the seminar, SSC would introduce changes to the draft and make it available for public opinions tentatively between now and the year end via a public seminar with expected participation of representatives from market players such as stock exchanges, securities firms, banking and finance institutions.

Once all the inputs have been collected, SSC would finalise the draft with the support from Project VIE/032’s international legal experts and send it to the government for submission to the National Assembly, which is scheduled to review the law and approve it within 2019, said SSC Chairman Tran Van Dzung.

"We have high expectation that the new generation of the securities law, once approved by the government to take effect in 2020, would continue to create a foundation for the next boom of the stock market and the financial market in the new period, meeting demand for fund raising and allocation, contributing to changing the growth model of Vietnam's economy", Dzung said on the sidelines of the seminar.

He also added that "We hold that between 2020 and 2030, and by 2040 the role of the stock market on allocating medium- and long-term funds for the sustainable development of the economy will be clearer, hence in the next generation of securities law, we ought to create conditions for enterprises as well as the government in raising funds and using funds more effectively, making more contributions to the economic development".

Mr Dzung expressed his great appreciation to the support from Project VIE/032 to help drafting the Law Amendments, organizing oversea study tours and consultation workshops – particularly providing experienced legal international experts so that SSC could summarize the experience from overseas markets. "They have also directly joined in dealing with issues of Vietnam's economy as well as putting those issues into the Securities Law, ensuring the development and a better management of the securities market in future." Dzung said.

Bridging Viet Nam and Luxembourg in Capital MarketsVIE/032 Project Launch

Friday 7 October 2016 set the mark for the official launch of the Luxembourg funded support project for capacity development in the Vietnam financial sector. VIE/032 project follows a successful first phase implemented between 2008 and 2013. This new phase will certainly build up on former achievements and will also support the Vietnam State Securities Commission (SSC) to cater more efficiently to the needs of a rapidly developing finance sector, be it via reformation of the existing legislative framework, inviting high-level experts to exchange knowledge and experience, as well as to upgrade existing IT systems.

LuxDev will be partnering with the Luxembourg training entity know as House of Training, which now includes the “Agence de Transfert de Technology Financière” (ATTF) to provide experts for training and technical assistance assignments for the development of Vietnam’s securities market. To even create a greater bond between Luxembourg and Vietnam in view of a platform for networking, exploring new ventures and business opportunities, the project has established an Alumni Association. This association assembles all graduates that have benefitted from ATTF’s trainings in the framework of the Luxembourg Development Cooperation activities in the Vietnam finance sector.

Aside from extensively working with SSC, the Hanoi and Ho Chi Minh City Stock Exchanges, the Vietnam Securities Depository, securities firms and listed companies, the project will also seek synergies with other involved donors such as the World Bank, the Asian Development Bank, and the International Finance Cooperation.

First off after the launch, the project will hire experts to support the updating of the legal framework and for derivatives training workshops to support capacity development ahead of the planned launch of the derivatives market in 2017. The project will seek to leverage Luxembourg expertise to provide these deliverables.